Last update. December 2022

This policy is part of our general terms and conditions, concerning the prevention against identity theft, financing of terrorism, organized crime, asset laundering and money laundering in force in the countries of operation of our platform, so that both guarantee the deconfiguration of illegal activities and the achievement of funds through illegitimate means.

Safesolf complies with the standards required by international regulations in this regard, so that security and compliance with the law prevail in our transactions, therefore our accessibility requirements for Distributors are rigorous, maintaining the necessary regulatory compliance to guarantee efficient security in such operations. Distributors are responsible for abiding by applicable laws regarding the legal use of the Platform in their local jurisdiction, as well as being in compliance with other laws and regulations applicable to them by connection.

These policies and any terms incorporated herein, apply to the Distributor, whether a natural person or legal entity, the use of the Services, including those offered in https://encriptados.io, the technology and any platform integrated into it and any related application associated with it, which are operated and maintained by SAFESOLF INTERNACIONAL S.A.S. or a third party, are subject to these conditions. For Colombia, the procedures for the prevention and risk control of Money Laundering and Financing of Terrorism are contained in our complete and updated SARLAFT Manual (Risk Management System for Money Laundering and Terrorist Financing).

This policy constitutes a binding and comprehensive agreement between SAFESOLF INTERNACIONAL S.A.S. and the Distributor, for which, as soon as you visit the website and use the services, you confirm that you have read and accepted these Terms of Use and the present policies in their entirety before completing the registration procedure, thus it is adopted and accepts the terms of use and data processing policies available on our website.

The Distributor accepts that the current Terms may be updated by SAFESOLF INTERNACIONAL S.A.S. At any time. If the Distributor does not read and accept these terms in their entirety, the Distributor must not use or continue to use the Services. We reserve the right to amend or modify these policies, adapting them to the continuous legislative changes, which will always be in force on our website home page.

The Distributor understands and declares to know that our Services give the possibility of marketing the products and services available on the website www.encriptados.io, in accordance with what is established in the Contract signed by the parties; For this reason, said activity implies the need to guarantee our security filters so that our privacy policies are fully complied with AML VERIFICACIÓN (anti-money laundering), KYC (know your customer), CIP.

Distributors are responsible for verifying whether they are allowed to carry out the transactions of the contractual object under the competent laws in their territory. The Platform exempts itself from any responsibility in the event of any illegality occurring or foreseeing in the transactions of the Distributors or their dependents, business partners, among others, SAFESOLF INTERNACIONAL S.A.S. is at the discretion of verifying the transactions and come to verify the illegality as the case may be and take actions in accordance with the competent laws and regulations, in the following cases:

The Distributor, with access to the platform, accepts our discretionary decision to take measures that range from limitation, suspension and closure of the account, if any previously exposed circumstances are noticed, due to the need to apply security and verification protocols, withdrawing said measures if the circumstances that caused them are corrected.

In order to use the functionalities of the platform in SAFESOLF INTERNACIONAL S.A.S. , the Distributor must pass the following registration processes, and identity verification, in order to collect the personal information of the Distributor, data such as their full name, place of residence, date of birth and address, so that they are compared with the official documentation provided by the Distributor, verification of the proof of real residence and the identity of the Distributor in competent official databases, in order of residence and jurisdiction factors.

This process begins from the supply of the Distributor’s data, whether he is a natural, legal or moral person; collecting your personally identifiable information, full name, place of residence, date of birth and address:

Email. Seniority and existence of said account is verified as well as a behavioral risk assessment based on the email address

The existence of the number is verified by sending an SMS message with verification code to the owner Distributor.

The uploaded document must contain at least the following data:

The upload of said document(s) in image, is necessary to execute specific verifications to determine if the document is valid, belongs to the Distributor and is reliable, also if said document was subject to alterations or manipulation, or the opening of other accounts on the platform with the identity document, which would effectively make the opening of the Distributor’s account unfeasible.

SAFESOLF INTERNACIONAL S.A.S. reserves the right to request a video or any other additional documents that allow full certainty of said identity.

Other features of biometric verification include:

In the case of a legal or moral person, the review of the adoption of AML policies or risk management in asset laundering and money laundering is also estimated in order to the competence and jurisdiction of the Distributor, under platforms attached to SAFESOLF INTERNACIONAL S.A.S. .

The anti-money laundering watch lists (AML) are issued by national and international organizations such as the FBI, Interpol and the United Nations, in which the names of people and companies that have participated in criminal activities rest, for this reason, our AML verification compares the Distributor against more than a thousand international watch lists, sanctions lists and lists of politically exposed persons (PEPs).

If a Distributor is found on any list, verification will be subject to a second review, either at the AU Government Department of Foreign Affairs and Trade, Inter-American Development Bank, GB Consolidated Target List Her Majesty’s Treasury Sanctions List – Persons of Interest Swiss SECO Sanctions, UK Bank of England Sanctions List, UN Consolidated Sanctions, US Bureau of Industry and Security Denied Persons in US US OFAC PEP

CIA World Leaders, Council of Europe Parliamentary Assembly, EU MPs, Colombian SARLAFT, US DEA, US FBI, INTERPOL Red and Black Notices, US Marshalls Service.

After said process, internally, the internal verification procedures were carried out, in order to give rise to the effective creation of a Distributor account accessible after the registration process and through the Services of the SAFESOLF INTERNACIONAL S.A.S. platform. Therefore, it is clear that you must go through all the AML/KYC procedures without inconvenience, which may be applied to you in accordance with our internal AML/KYC policies. As part of said procedures, SAFESOLF INTERNACIONAL S.A.S. reserves the right to request additional information and documents, which are intended, among others, to identify our Distributor and prove the origin of the funds;

The Distributor must manage and maintain only one account of SAFESOLF INTERNACIONAL S.A.S. , for which it is obliged to:

We strive to protect our Distributors from fraud and fraudulent activities in the field of crypto assets. Some crypto assets may be intended for illegal seizure of property, or construed as fraud, scam, or any other activity recognized by law as illegal and/or not in compliance with legal requirements. SAFESOLF INTERNACIONAL S.A.S. cooperates with law enforcement agencies and other competent authorities to determine and disclose such crypto assets. We reserve the right to prohibit and discontinue any Exchange through our Services with such crypto assets at our sole discretion, without prior notice and without publishing the reason for such decision, provided that we are aware of it. Upon entering the platform, the Distributor INDEMNIFIES AND RELEASES SAFESOLF INTERNACIONAL S.A.S. LIABILITY WISE AGAINST ANY CLAIM, DEMAND AND DAMAGES, WHETHER DIRECT, INDIRECT, CONSEQUENTIAL OR SPECIAL for said security reason and verification in these policies.

This document has been prepared by LegalAB – Colombia, in accordance with Colombian legislation, especially the data processing policies applicable in Colombia and international data transmission. This document enjoys full legality between the parties and between those who are browsing or accessing the contents, products and services of the www.encriptados.io platform, for which its reproduction, copying, extraction and/or any usurpation of content without the authorization of the owner SAFESOLF INTERNATIONAL S.A.S.

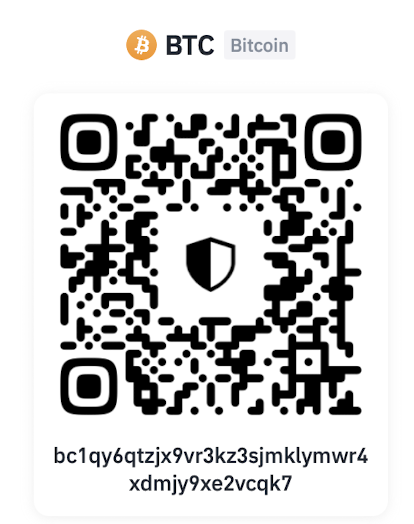

BTC, ETH, USDT, DOGE, DAI, Etc...

T

BTC, ETH, USDT, DOGE, DAI, Etc...

Using the wrong network (blockchain) will result in the loss of funds.

Total a pagar:

N°

Send to @encriptados on Telegram your order number and your payment receipt to confirm your order.

Total:

N°

Bancolombia

Cuenta Ahorros: 259 804315 01

Nit: S901054325-9

Nombre de empresa: Safesolf Internacional SAS

Para inscribir la cuenta en Bancolombia debe quitar el -9 del nit

Send to @encriptados on Telegram your order number and your payment receipt to confirm your order.

Go to Encriptados' TelegramSteps:

1. Go to the nearest Crypto ATM

2. Select "Buy Bitcoin"

3. Enter the value of your purchase

4. Scan the barcode (that we present to you)

5. Enter the value of your purchase in cash

6. Confirm your purchase

7. Take a photo of the completed transaction.

Send to @encriptados on Telegram your order number and your proof of payment, to confirm your order.

Only deposit the value of your purchase, we assume the cost of the ATM transaction

Click here and get your code for ATM payment

Total:

N°

Send to @encriptados on Telegram your order number and your payment receipt to confirm your order.